LeverageShares announced an ETF which drew the ire of many market watchers. In an Elm Research blog post, the author suggests the proposed structure would not benefit from the underperformance of leveraged ETFs, called the leverage or volatility drag. We’ll save discussion of leverage drag for another day. Looking at a simulation of the proposed ETFs structure (see below) paper trading over the past 12 months suggests there are market conditions that are supportive of the strategy.

When does it work? In mean reverting market environments.

When does it fail? In trending markets.

We set up a simulation that will short TQQQ and SQQQ in equal amounts. The Return on Investment shows the ETF underperforming over longer time periods as one might expect, given the inherent drags in fees and leveraging. However, this ETF, while not a silver bullet, it does collect some upside from leverage drag. If it were launched 12 months ago, its return would have been around 5.87%.

The fund is set up in a way to be long volatility, and short gamma.

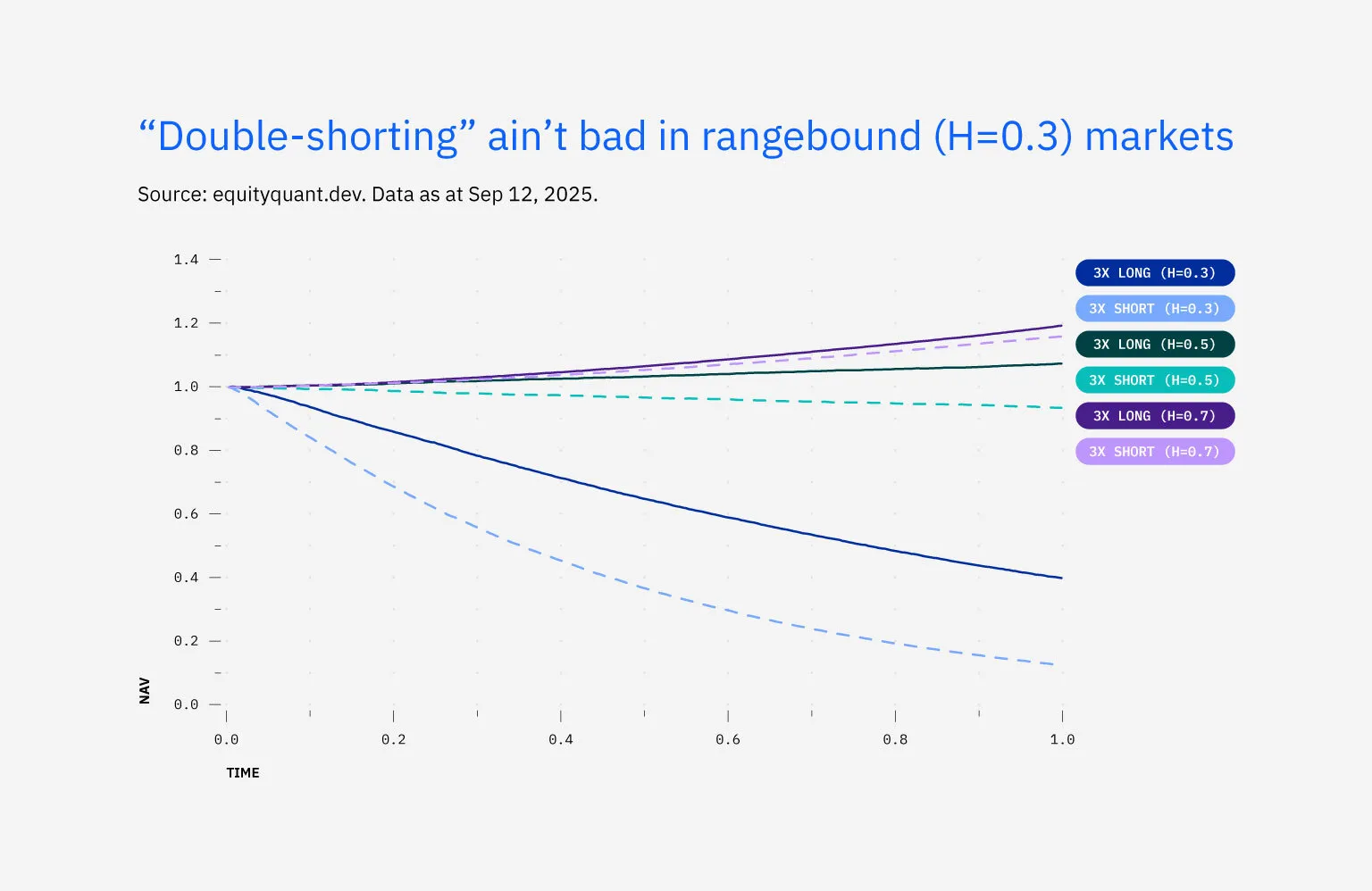

In the chart below you will see a sim of performance of the double short ETF (if it ever goes live) in three Hurst parameters (0.3, 0.5 and 0.7) representing mean reverting, neutral and trending market environments.