When comparing buffers we must stay cognisant of the strategy. Comparison is said to be the thief of joy. In investing, ranking funds by Sharpe and Sortino ratios is meaningful in the quest to maximise returns.

However, a buffer fund is not trying to beat the S&P 500 in the same way a safety car is not trying to outpace Oscar Piastri in Formula One. Indexing and benchmarking are necessary in a market where there are more ETFs than stocks. But, if the grouping has such variations among constituents then median values are not meaningful. These funds are, for the most part, acting out the strategy they list in their mandate. No more, no less. They may underperform the S&P 500 Total Return Index, but that shouldn’t be a surprise.

Ask a buffer fund manager and they will say the Bloomberg All Hedge Index (BHEDGE) is a more fitting benchmark.

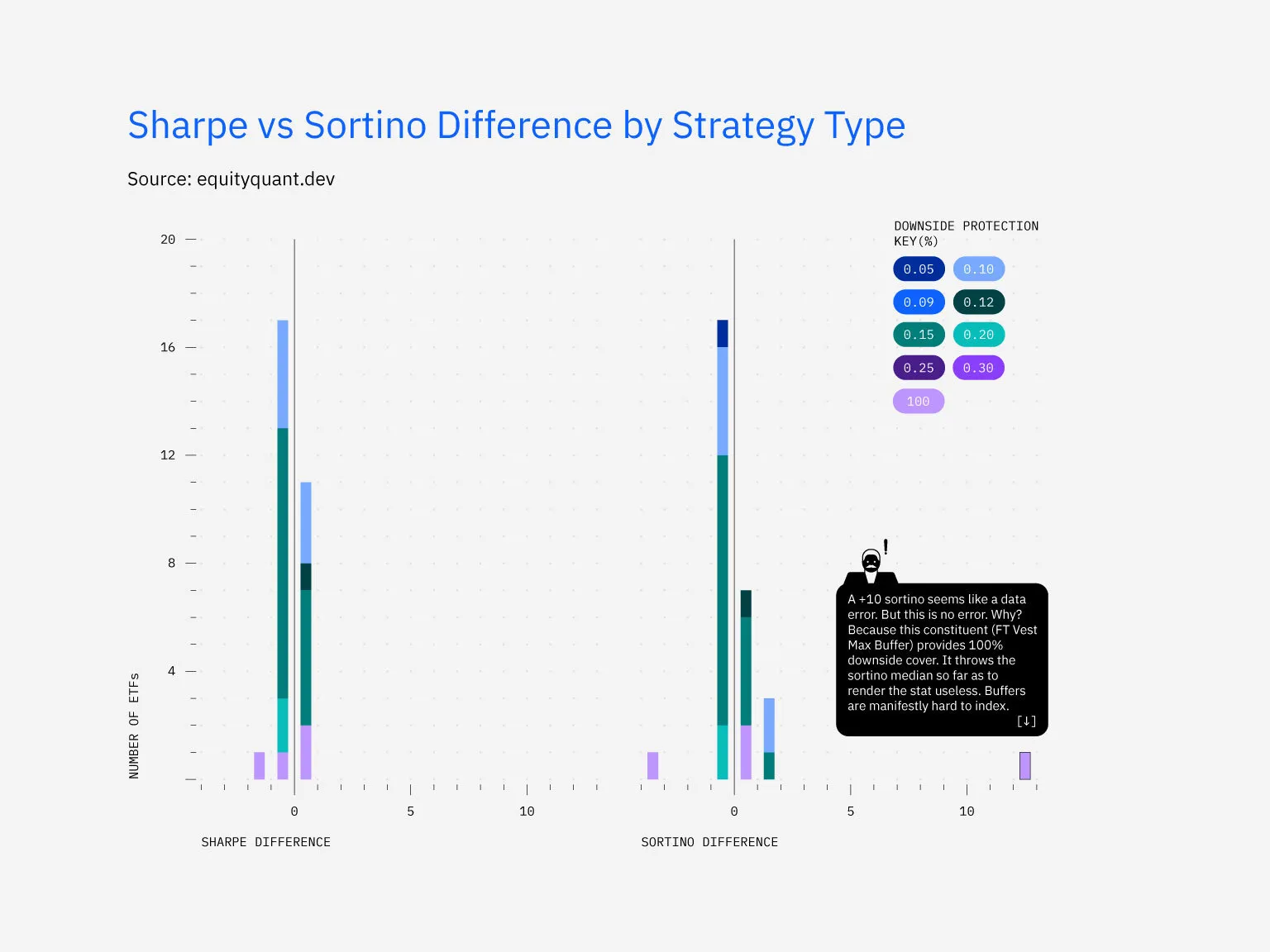

In the chart below you will see the wide range of buffer Sharpe ratios over the long term. Trying to derive meaning from the median is a fool’s errand.