SUVU, or Stock Up Vol Up, is an acronym I first heard described on an episode of Dean Curnutt’s Alpha Exchange podcast. He uses it to describe stocks that can and frequently do experience “up crashes”. As such, the options interest across puts and calls is uniform, suggesting market participants are hedging both drawdowns and these upcrashes. This is an observation more commonly associated with Bitcoin, but also applies to several US listed companies.

What makes a SUVU stock? High valuation is common across Nasdaq listings. So, this alone, doesn’t distinguish what makes the SUVU cluster so unique. We have noticed the stocks typically have volatility readings 3 and 4 times the VIX. Also, each high volatility stock is a village unto itself. They have deep options markets, notable swap activity and in some cases have both long and inverse leveraged ETFs using their performance as the benchmark. High volatility is the jetful of financial innovation these days.

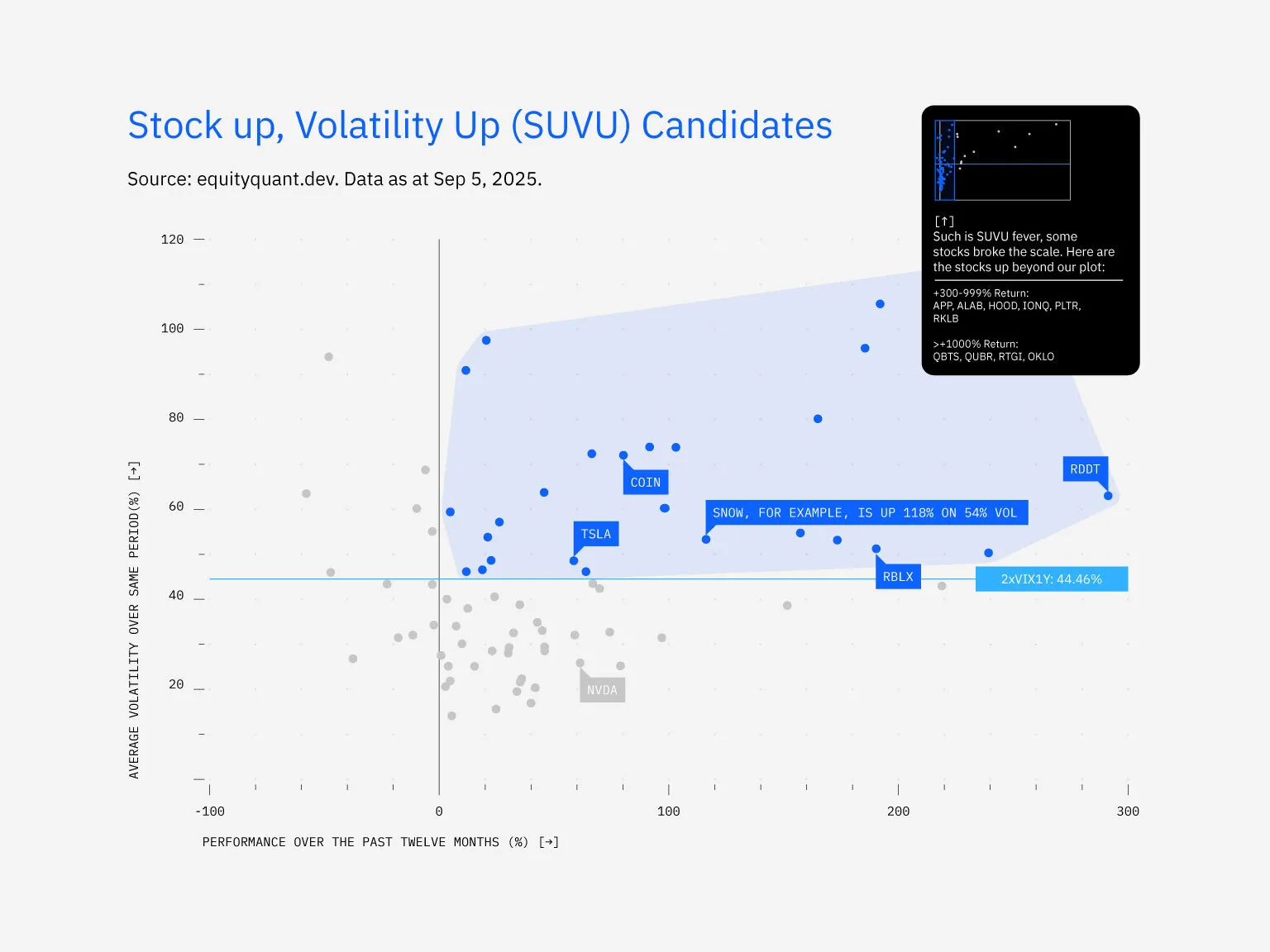

In the plot below are 84 US listed equities sorted by 1-year performance and implied volatility. The up-and-to-the-right cluster are our SUVU stocks. Area denotes market cap.