Blog

The VIX one day index (VIX1D) uses the zero and one day expiration cycles. It works in business days, whereas the conventional Vix uses calendar days.

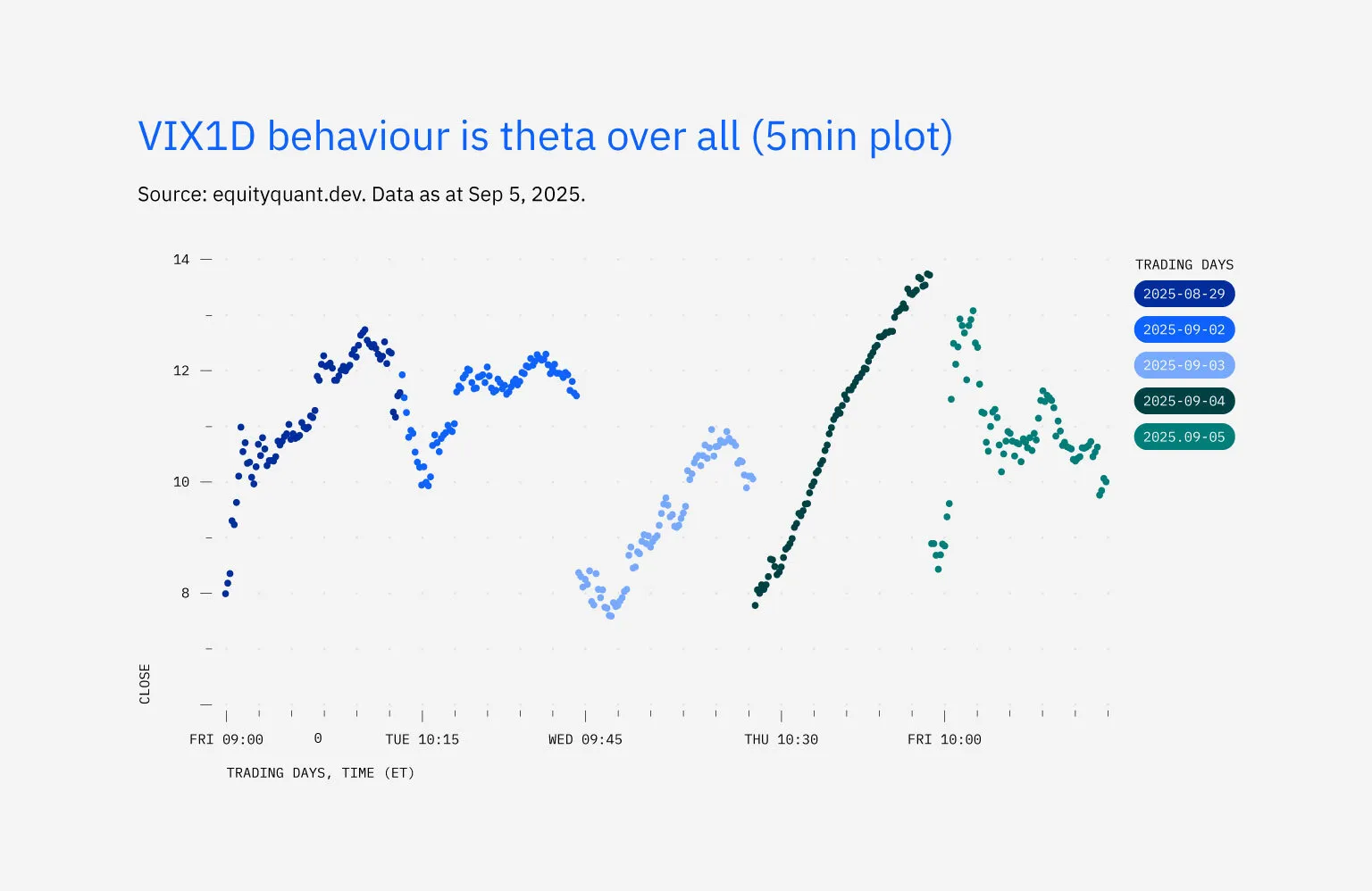

It scales higher as its weighting tends towards options trading one day trading day into the future. The zero contracts “rots” with theta decay, in the same way the price of today and tomorrow’s bananas would change dynamically as we throw out today’s brown and soft bananas and bring in tomorrow’s green ripe bananas. This can be seen in recent readings, where we have grouped Friday and the following Tuesday. This is because these would have been the two contracts in play on that Friday.